Fantastic Info About How To Reduce Tax In India

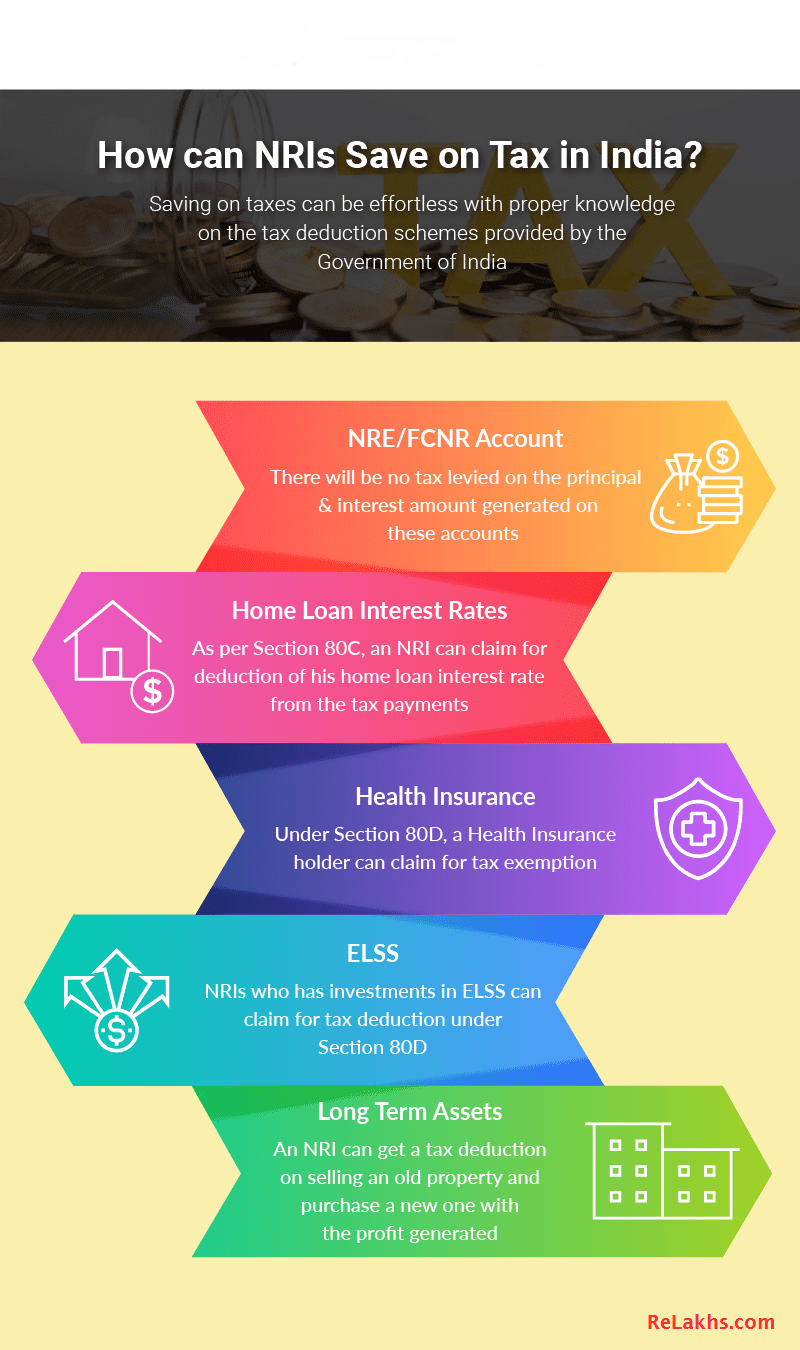

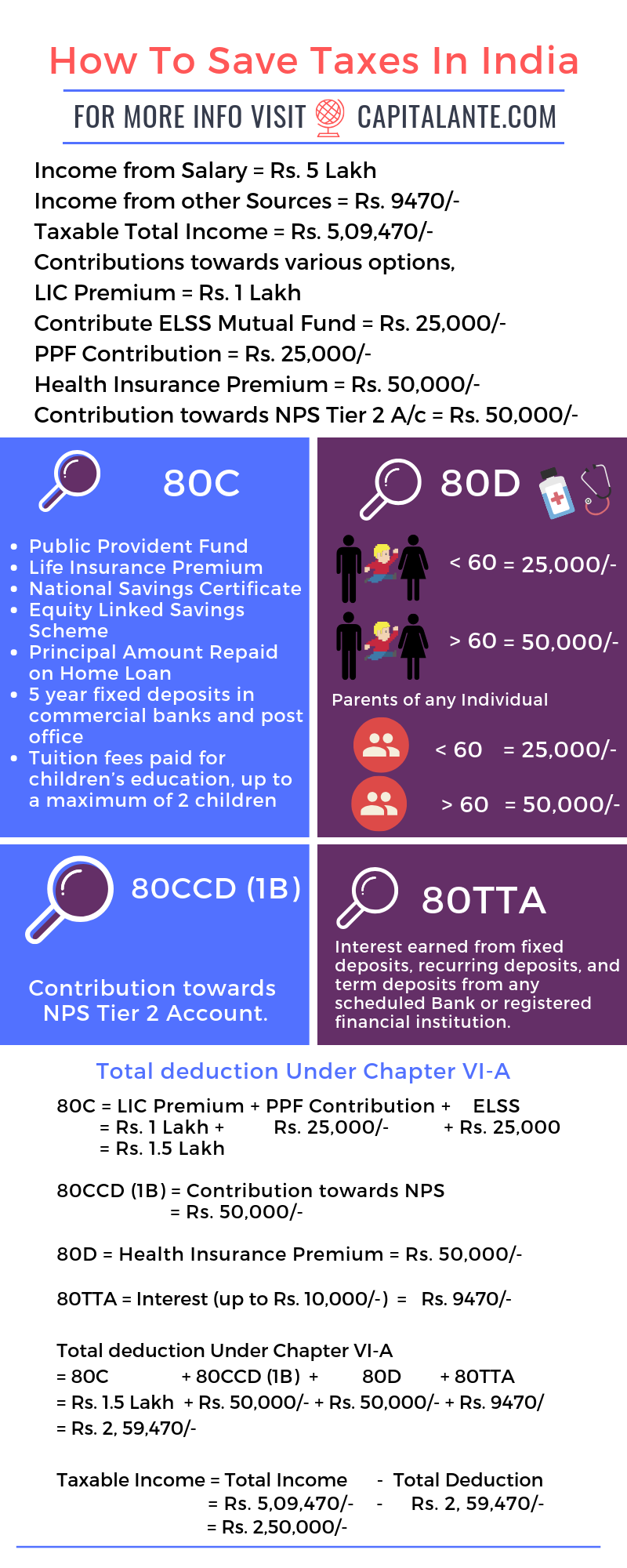

1) tax saving with nps under section 80ccd (1b):

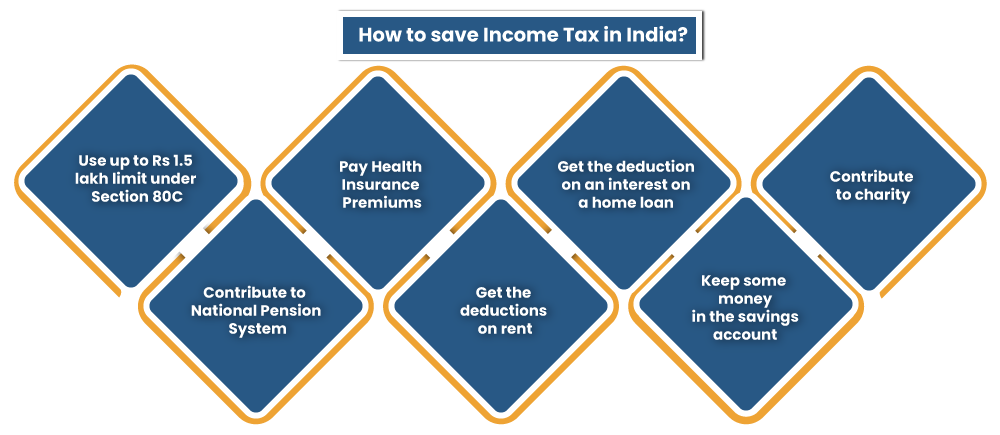

How to reduce tax in india. How to save tax on salary in india? But there are many other ways to reduce the burden of. In this article, we are listing 10 ways beyond the section 80c route by which taxpayers could save on income tax.

Section 80c of income tax, the rs. What are the options to reduce tax liability legally in india? These are few questions arising as countdown started for tax payment in india.

The maximum of hra is 50% of your basic. In cases where hra is not a part of the salary, then the tax benefit can be availed by firstly, subtracting rent from 10% of income, secondly, a flat rate of inr 5000 on a monthly. Here we are going to describe how a person can save on taxes by taking some simple steps.

Reduce your taxable income by up to rs 50,000 more if parents are 60 or above (rs 25,000 for below 60) you can claim medical expenses as well for senior citizen parents; How to save income tax in india. Income tax laws provide the opportunity.

By shifting to lower income slab obviously. Deductions under section 80c ppf (public provident fund) elss funds. You freebies want free electricity, water, rice, etc and public roads like singapore, public health care like netherlands, but can't pay direct tax to.

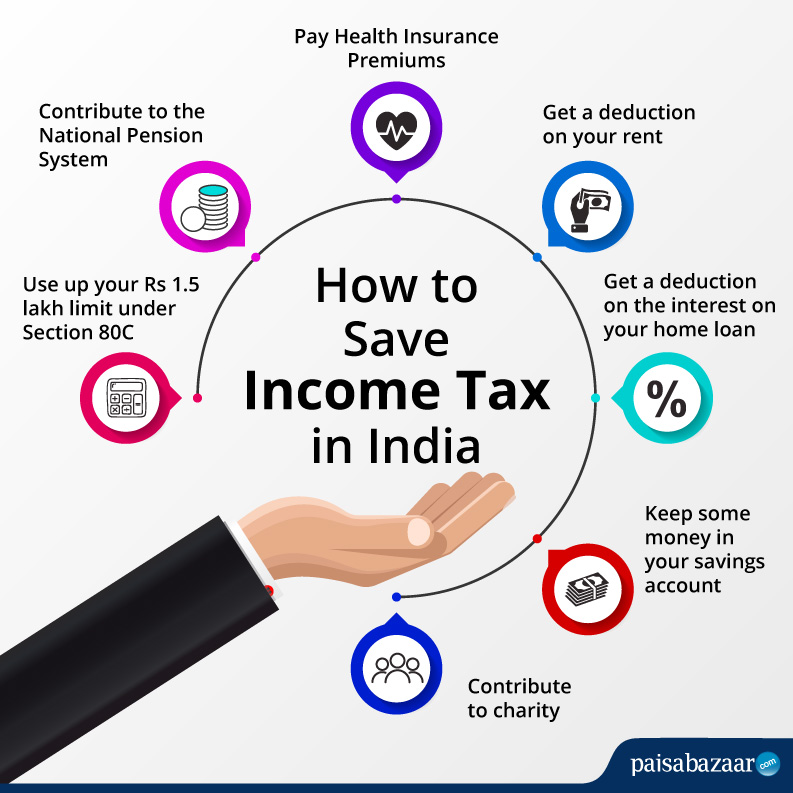

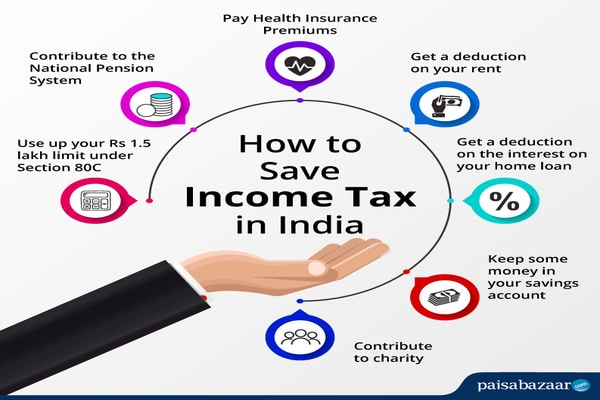

Guide to save income tax in india: Use up your rs 1.5 lakh limit under section 80c. Ppf is an income tax saving account started by the government of india.